It’s been some volatile 48 hours. The market’s recent sideways consolidation came to an abrupt end with a sharp, aggressive sell-off in the last 24 hours.

Bitcoin led the move, falling from a high of around $103,100 to test support near $95,000: a drop of nearly $8,000, or approximately -8.0%. Ethereum was hit even harder on a percentage basis, plunging over 12% from its 24-hour high of $3,510 to trade around the $3,100 level.

When prices move this fast, it’s crucial to look past the noise and see what the on-chain data is telling us. For this weekly update, we’re digging into four key metrics: ETF flows, on-chain growth, network fees, and a big week for token unlocks.

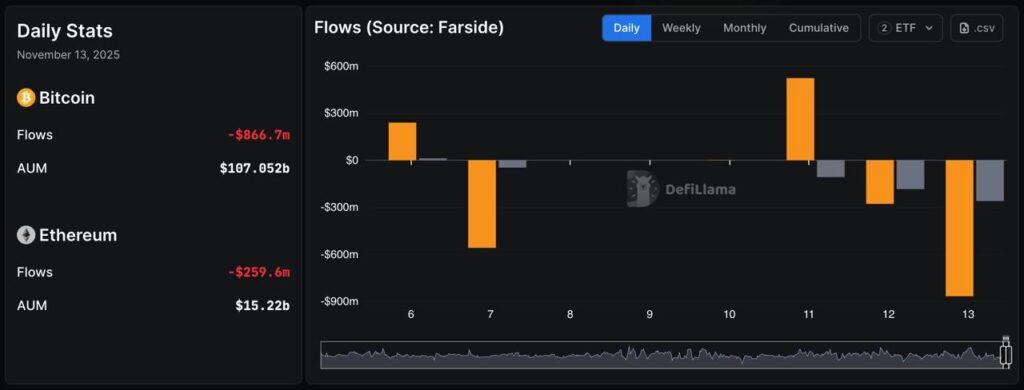

ETF flows: Reading the reaction

After a sharp drop, the first place we look for institutional sentiment is the spot ETF market. Did they panic-sell, or did they see this as a buying opportunity?

The data from this week shows a decisive move to de-risk. As the chart shows, November 13th was a day of significant withdrawals, with Bitcoin spot ETFs seeing a massive net outflow of $866.7 million, and Ethereum-based ETFs seeing $259.6 million exit the funds.

What this tells us is that there was no wait-and-see this time. This was a clear institutional sell-off, suggesting that for now, large players are prioritizing capital preservation over buying the dip.

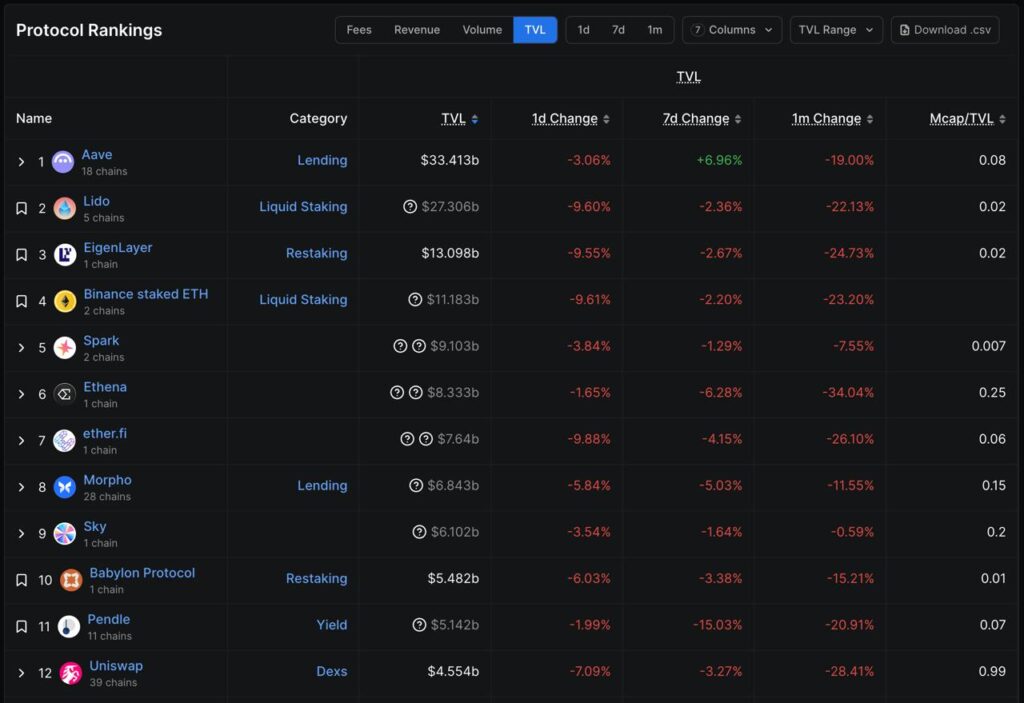

TVL growth: Where did the capital go?

In a week defined by a sharp, market-wide sell-off, did any ecosystem manage to hold its ground? When we look at the total value locked (TVL) growth over the last 7 days (for chains with over $50M in TVL), the picture is bleak, but with a few interesting exceptions.

As the chart clearly shows, the sell-off was felt everywhere. The top 10 protocols by TVL are almost all in the red over the last 7 days.

Big names like Lido and EigenLayer saw 7-day outflows, showing that even the market leaders aren’t immune to a risk-off move.

The interesting exception here is Aave, which, despite the market drop, managed to post a 7-day TVL gain of nearly 7%. This suggests that during volatility, some capital may move into established blue-chip lending protocols, possibly seeking stability or to take advantage of borrowing dynamics, rather than exiting the ecosystem completely.

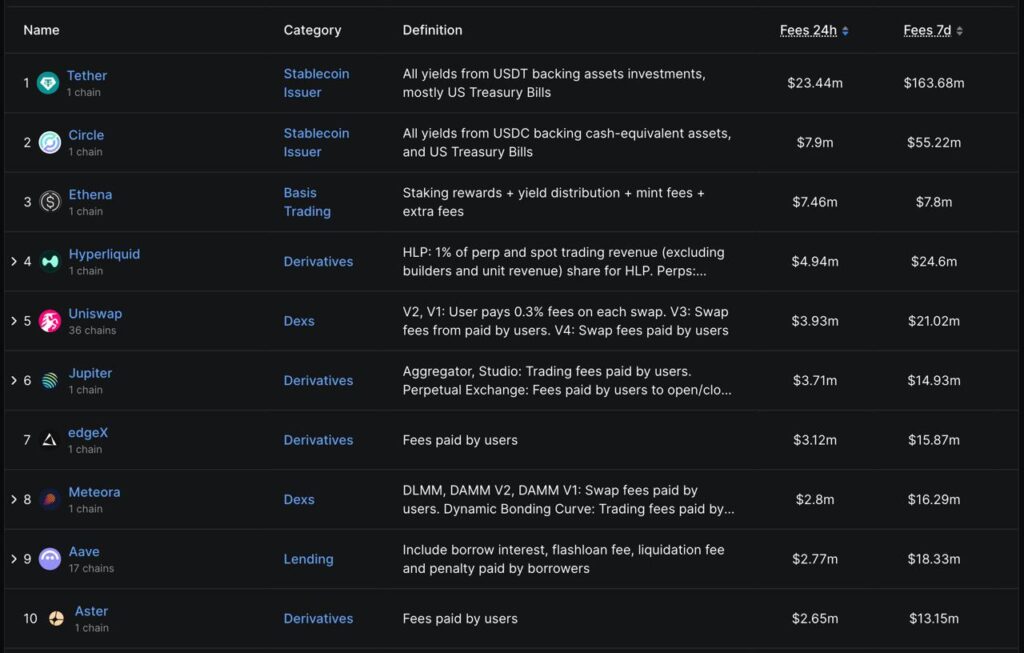

Where’s the activity? Following the fees

If you want to know what users actually value during a sell-off, follow the fees. High fees mean high demand for a service, and this week’s data tells a clear story.

Unsurprisingly, the data is dominated by stablecoins. Tether ($163.68m) and Circle ($55.22m) generated the most fees. This makes sense: in a market panic, capital floods to safety, and every transfer or swap into stablecoins costs money.

But the more interesting story is what comes next. The highest-earning activity protocols were derivatives platforms, including Aster ($2.65 m) and DEXs like Uniswap ($21.02 m). This shows that traders weren’t just running for the exits; they were actively repositioning, managing leverage, and swapping assets.

We also see lending protocols like Aave ($18.33m) high on the list, likely driven by a spike in liquidations and users borrowing stablecoins against their volatile collateral. The fees show a market in full motion.

On the horizon: Major token unlocks

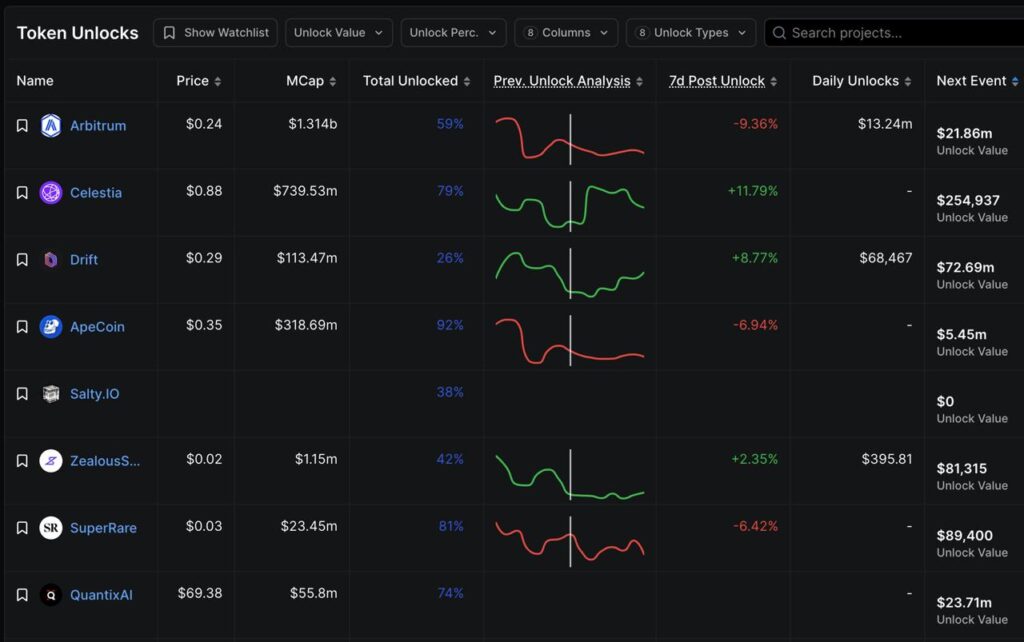

Finally, we look at supply-side events. Next week is a big one for token unlocks, and we’re watching three projects in particular from the list, all of which are tradable on the IXFI spot market.

It’s important to know that unlocks don’t automatically mean a price drop, and the chart gives us great insight into this.

- Celestia (TIA): Despite recent unlocks, TIA shows an +11.79% performance in the 7 days post-unlock, suggesting demand is currently absorbing the new supply.

- Arbitrum (ARB) & ApeCoin (APE): On the other hand, both ARB and APE are showing negative 7-day performance (around -9.36% and -6.94% respectively), indicating the new supply is adding pressure in a weak market.

Given the current market fragility, it will be crucial to see how the market absorbs the next scheduled unlocks for these assets.

Conclusion

This week was a reminder of how quickly sentiment can shift, defined by a sharp, institutional-led sell-off.

But the data shows a story more complex than just panic. While capital exited ETFs, it was also highly active, flooding into stablecoins and being used on DEXs and lending protocols. We saw a flight to quality, with established protocols like AAVE holding their TVL better than others.

The market is now in a fragile position: reset by the sell-off, but facing significant new supply from the upcoming ARB, TIA, and APE unlocks. How the market absorbs this new liquidity will likely set the tone for the week ahead.