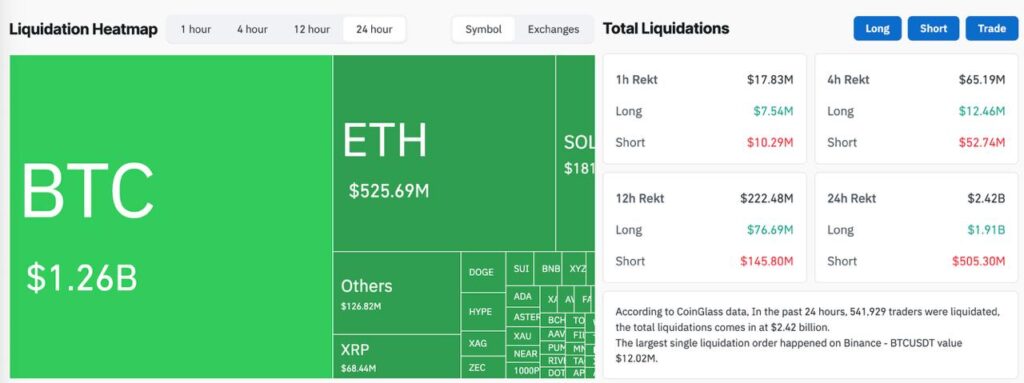

Stats over the last day (provided by Coinglass):

- Total liquidations (24h): $2.42 billion.

- Traders wiped out: 541,600 people.

- The whale loss: One single order lost $12 million instantly.

- Longs vs shorts: It was a massacre for the bulls. Over $984 million in Bitcoin long positions were liquidated, compared to just ~$270M in shorts.

- Price action: We dropped from the $76k range straight down to a wick of ~$60,000, before bouncing back to $67,000.

A few days ago, we posted an analysis asking a simple question: Will the support hold?

At the time, Bitcoin was sitting comfortably at $76,000. We warned that if support broke, the drop would be fast and violent.

Well, the market just gave us the answer.

We didn’t just break support; we smashed through it. In a matter of hours, Bitcoin wicked all the way down to $60,000 before bouncing back to the current $67,000 level.

If you are looking at your portfolio today, feeling uneasy, zoom out. We need to talk about leverage, liquidity, and why being a spot trader on IXFI just saved your account.

The Bloodbath by the Numbers

Let’s look at the damage. This wasn’t a normal correction; this was a mass extinction event for gamblers.

According to the data:

- In just 24 hours, $2.42 billion was wiped off the table.

- 541,600 traders saw their accounts hit zero.

- One single unfortunate trader lost $12 million in a split second.

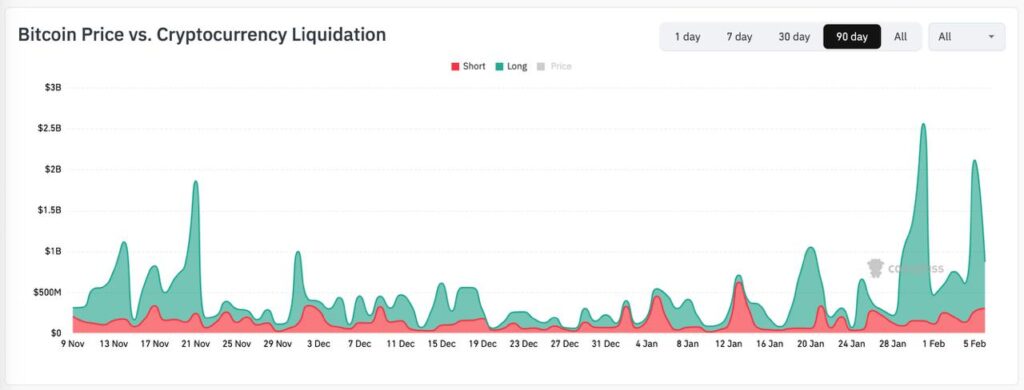

Anatomy of a Flash Crash

Why did the price drop so hard, so fast?

It wasn’t because people stopped believing in Bitcoin. It was because too many people were betting with money they didn’t have.

Look at this chart. You can see the massive wick down to $60,000.

When Bitcoin slipped below $74,000, it triggered a chain reaction. Traders who were long (betting the price would go up using 10x, 50x, or 100x leverage) got forced out of their positions.

The stats show that $984 million worth of Bitcoin longs were liquidated in just 24 hours. Every time a long position is liquidated, the exchange automatically sells that Bitcoin, pushing the price down further, which triggers the next liquidation.

It’s a domino effect. And it only stops when there is no one left to liquidate.

The IXFI Difference: Why spot is safer

This brings us to the most important point.

We often get asked, Why doesn’t IXFI offer high-leverage trading? Yesterday had the answer.

Let’s compare two scenarios from yesterday:

- Scenario A (leverage trader): Had 1 BTC at $76,000 and used 10x leverage to try to double his money. When the price hit roughly $69,000, his account was liquidated. He now has 0 BTC. He is out of the game.

- Scenario B (IXFI spot user): Had 1 BTC at $76,000. The price dropped to $60,000. He still has 1 BTC. The price bounced to $67,000. He still has 1 BTC.

If you are holding spot, you haven’t lost anything unless you sold at the bottom. You rode the roller coaster, sure, but you are still in the seat. The 541,000 traders who got liquidated yesterday? They fell off the ride.

What’s next?

The market has flushed the system. The excessive greed is gone, and the leverage has been reset.

We are now rebuilding from the $67,000 level. Volatility might stick around for the weekend, but the worst of the leverage flush is likely behind us.

Stay calm, stick to spot, and think long-term.