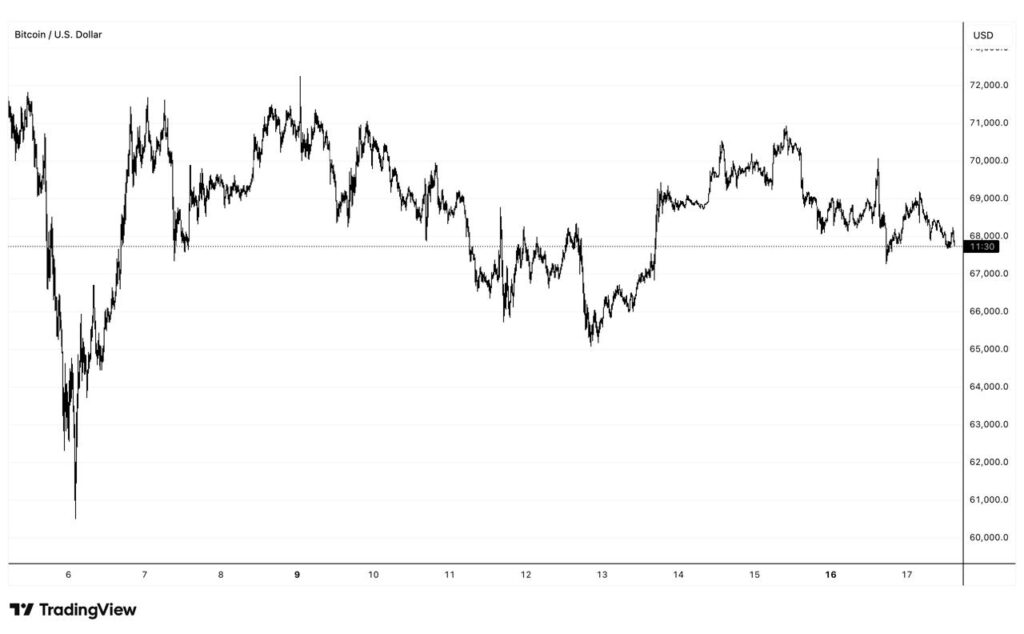

It has been 11 days since the flash crash that shook the market.

If you remember, back on February 6th, Bitcoin plummeted to $60,000 in a matter of hours. The sentiment was fearful. Many retail traders expected the worst – a repeat of 2022, where one crash leads to another, dragging us down into a long winter.

But today is February 17th. We are sitting at $68,000. The panic is gone. The volatility has vanished.

Why didn’t the market keep crashing? The answer lies in a concept that is defining the 2026 cycle: The institutional floor.

The boring phase (and why it’s good)

Look at the price action from the last 10 days.

After the violence of the crash, the market entered a range. We touched a high of ~$71k, dipped to a higher low of ~$64k, and are now hovering around $68,000.

To a day trader, this looks boring. But to an analyst, this is bullish. This sideways movement is called accumulation.

When retail traders panic sell, institutions don’t buy all at once (which would spike the price). They buy slowly, using algorithms to scoop up Bitcoin within a specific range. They are essentially building a floor under the price.

The $60K rejection

We need to look closely at how the market reacted when it hit $60,000.

See that long tail (wick) on the daily candle?. That represents a massive amount of buy orders getting filled instantly.

In previous cycles, a drop like that would have triggered a cascade of further selling. This time, it hit a wall of money. That wall is the institutional floor.

Big players – ETF issuers, pension funds, and family offices – have likely identified the $60K zone as undervalued. They aren’t trading for a quick 10% flip. They are accumulating for the next 5-10 years. As long as they step in at these levels, it becomes very difficult for the price to stay suppressed.

Retail panic vs. Institutional patience

Right now, there is a disconnect in the market:

- Retail investors: Are nervous because we haven’t returned to all-time highs yet. They see $68,000 and think it’s struggling.

- Institutions: Are comfortable. They are happy to keep buying Bitcoin under $70K for as long as possible.

This is why shorting (betting against) Bitcoin right now is dangerous. You aren’t just betting against crypto enthusiasts anymore; you are betting against the deepest pockets in global finance.

Our perspective

This price action validates exactly why we encourage spot trading.

If you panicked and sold on leverage during the crash on Feb 6, you were wiped out. But if you held spot, you simply watched the price go down to $60K and come right back up to $68,000. Your Bitcoin balance remained the same.

The market has a safety net now. It doesn’t mean prices can’t dip – we saw that they can. But it does mean that deep dips are being bought up faster and more aggressively than ever before.

Be patient. Let the big players finish their accumulation.