Let’s cut straight to the chase. Bitcoin is moving around $76,000, and the market feels indecisive.

Everyone is asking the same question: Is the bull run over, or is this just a pit stop before $100k? More importantly, for those of you holding heavy bags of altcoins, When is it our turn?

To answer that, we need to look at the charts: specifically support, resistance, and the most important metric of all: Bitcoin dominance.

Here is the technical breakdown of the market:

Bitcoin: The $76k pivot

Right now, $76,000 isn’t just a random number. It is a critical line in the sand.

- Current status: Consolidation.

- Key support ($72,000 – $74,000): If we lose the $76k level on a daily close, the next major safety net is down in the $72k-$74k region. This is where buyers have historically stepped in aggressively.

- Key resistance ($80,000): To flip bullish again, BTC needs to reclaim $80,000 with volume. Until we see a clean break above that, we are technically in a choppy market.

The strategy: Patience. If you are trading BTC, you are waiting for a bounce off $74k or a breakout above $80k. Anything in between is just noise.

The magic number: BTC Dominance (BTC.D)

This is the chart that matters for your altcoins.

Bitcoin Dominance has been relentless, sucking the liquidity out of the rest of the market. Usually, Altseason only triggers when BTC Dominance hits a major resistance level and gets rejected hard.

- What to watch: We are looking for a sharp drop in dominance while Bitcoin’s price remains relatively stable.

- The trigger: If BTC.D starts falling, that capital has to go somewhere. It usually flows into Ethereum first, then high-caps like Solana, and finally into utility coins like LINK.

The IXFI Watchlist: 3 Alts to Watch

While Bitcoin decides its next move, here are three altcoins showing interesting technical setups on IXFI.

Ethereum (ETH) – The Safety Play

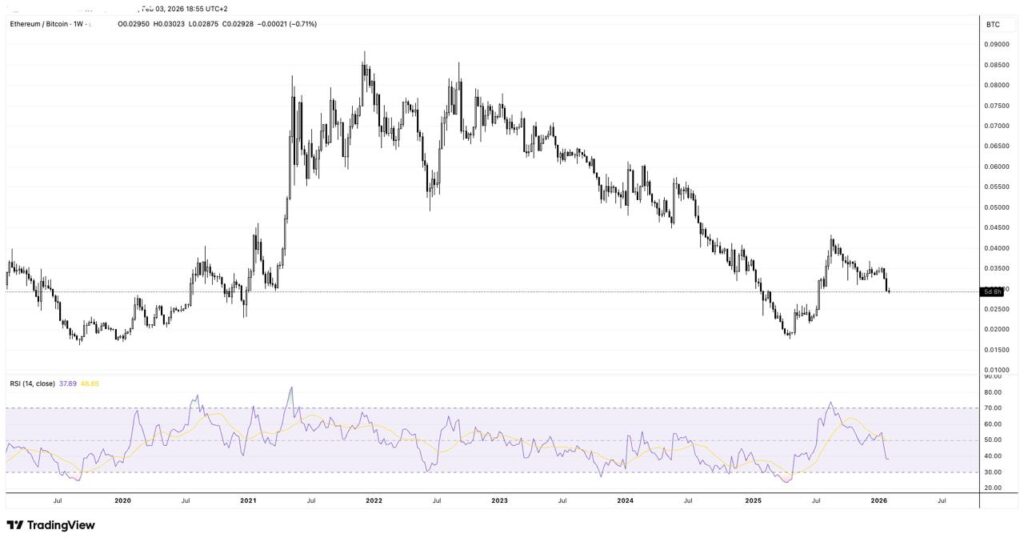

The ETH/BTC ratio has taken a beating recently, sitting near multi-year lows.

- Technical view: From a risk/reward perspective, ETH at these levels is historically a strong accumulation zone. If the rotation happens, ETH is the first mover.

- Support to watch: The $2,000 zone against USDT.

Solana (SOL) – The Momentum King

Solana has shown incredible strength relative to the rest of the market.

- The level: Watch the $80 – $100 area. This has acted as a springboard in the past. If SOL holds this level while BTC stabilizes, it often leads the recovery rally.

- Resistance: The road opens up significantly if it clears $120.

Chainlink (LINK) – The Builder’s Play

Instead of chasing meme volatility, we are looking at infrastructure. LINK has been quietly building a massive base.

- The setup: LINK tends to move late but hard. It has established a very strong floor.

- The trade: We are watching for a reclaim of key resistance levels. It’s less volatile than the newer coins, making it a safer bet for a medium-term hold if the market turns bullish.

Summary: Don’t FOMO yet

The market is testing your patience. The setup for an Altseason is building, but it hasn’t triggered yet.

Your checklist for this week:

- Does Bitcoin hold $76,000?

- Does Bitcoin Dominance start to drop?

- Are big caps like SOL holding their support levels?

If the answer to all three is Yes, get ready. The rotation is coming.

Trade safe.